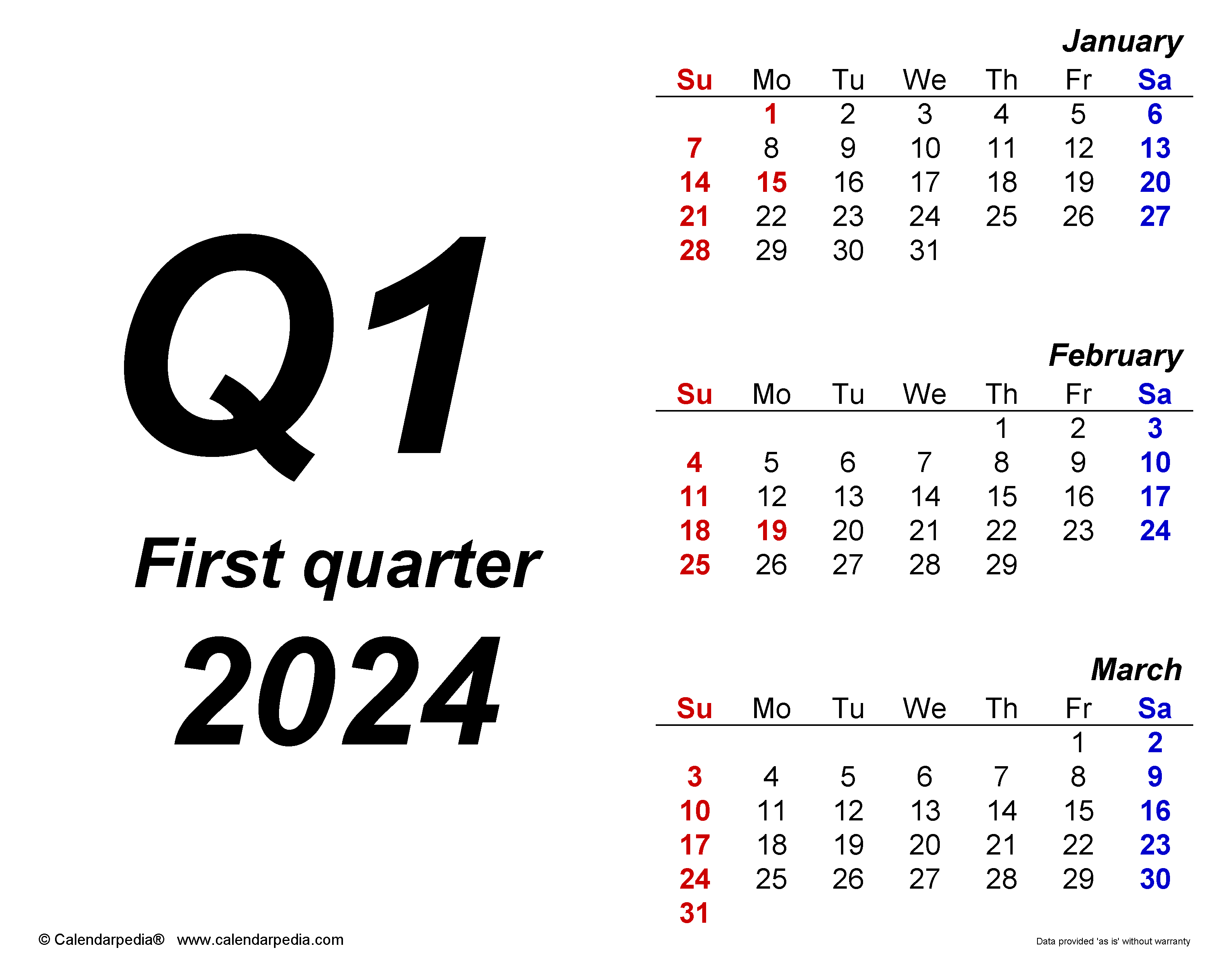

When Are Q4 2025 Estimated Taxes Due. In 2025, estimated tax payments are due april 15, june 17, and september 16. When are estimated tax payments due?

When Are 4th Quarter Taxes Due 2025 Robin Tamarah, Estimated tax payments are typically made incrementally, on quarterly tax dates: The main tax deadline for personal taxes is monday, april 15, 2025.

When Are Q4 Estimated Taxes Due? 2025 Federal Tax Zrivo, When are estimated tax payments due? The first three quarterly estimated tax payments were due on april 18, june 15, and september 15, 2025;

YearEnd Bookkeeping Tip 2 Preparing Q4 estimated taxes, What are the safe harbor tax rules? The due dates for these 2025 payments are april 15, june 17, september 16, and january 15 (2025).

Estimated Tax Due Dates [2025 Tax Year], Price as of march 27, 2025, 4:00 p.m. (note that some people will have extended irs tax deadlines for.

Estimated Tax Due Dates [2025 Tax Year], Corporate tax deadlines and calendar. When are estimated tax payments due?

2025 Tax Calendar Mark Your Dates! Filing Season and Key Deadlines, The due dates for the first three payment periods don't apply to you. Corporate tax deadlines and calendar.

![Estimated Tax Due Dates [2025 Tax Year]](https://youngandtheinvested.com/wp-content/uploads/estimated-tax-due-dates.png)

Traders Should Focus On Q4 Estimated Taxes Due January 18 Green, You can pay all of your estimated tax by april 15, 2025, or in four equal amounts by the dates shown below. We’ll set you up with a dedicated team of bookkeepers and a.

![Estimated Tax Due Dates [2025 Tax Year]](https://wealthup.com/wp-content/uploads/estimated-tax-due-dates-2.jpg)

When Are Q4 Estimated Taxes Due? Jeremy A. Johnson, CPA P.C., Updated for tax year 2025. April 15, 2025 2nd payment.

Reducing Estimated Tax Penalties With IRA Distributions, In 2025, estimated tax payments are due april 15, june 17, and september 16. How do i determine my estimated quarterly.

2025 Tax Return Schedule Hope, This article is tax professional approved. Technically, estimated payments are due as income is earned, so if you haven't made any payments for.